OP

Member

LEVEL 5

50 XP

Curso completo de PHP

Last updated 1/2024

Duration: 66h 46m | Video: .MP4, 1920x1080 30 fps | Audio: AAC, 48 kHz, 2ch | Size: 32.8 GB

Genre: eLearning | Language: Spanish

desde sus bases hasta hacer aplicaciones (actualizado a la versi n 8.2)

What you'll learn

Aplicar los diferentes tipos de datos que se manejan en PHP y las reglas generales para nombrar las variables.

Aplicar los diferentes operadores en PHP como operadores aritm ticos, de asignaci n, bit a bit, de comparaci n, l gicos, entre otros, as como su precedencia.

Conocer y aplicar las diferentes sentencias condicionales, su anidaci n, la estructura else if, el uso de switch y del operador condicional.

Conocer y aplicar los diferentes estructuras c clicas de PHP como el ciclo while, do...while, for y los comandos break y continue.

Aprender a crear los arreglos, la estructura c clica foreach y las funciones para a adir y eliminar elementos, as como el ordenamiento de arreglos num ricos y asociativos.

Crear funciones personalizadas con par metros y la palabra reservada 'return', as como las nuevas caracter sticas en PHP7 de los valores predeterminados, declaraciones de tipo.

Validar los datos de un formulario de HTML con PHP, desde datos escalares como datos m ltiples, redireccionamiento a otras p ginas con el comando header() y el uso de plantillas.

Aprender a validar fechas con PHP, crear nuevos objetos de fecha y cambiar la zona horaria, as como convertir una cadena a fecha.

Aprender a formatear los datos, tanto las cadenas como los n meros, reaiizar una serializaci n de los mismos y crear filtros para la serializaci n con PHP7.

Aprender a modificar, cortar y sanear cadenas con PHP, asi como aplicar las funciones matem ticas

Manipular los archivos y directorios del servidor (fileSystem) por medio de PHP.

Aprender a abrir, leer y escribir en los archivos del servidor.

Aprender a crear, modificar y eliminar las galletas o cookies.

Aprender a conectarse a MySQL, as como a insertar, modificar, seleccionar y eliminar datos de las tablas de la misma.

Crear una galer a de fotos tomadas desde una carpeta del servidor, optimizar las im genes as como aplicar diferentes filtros a las mismas y subir una imagen de la m quina del usuario.

Aprender a leer y escribir en archivos con formato XML y JSON.

Aprender las operaciones b sicas para crear gr ficas con Google Chart tomando la informaci n de una base MySQL por medio de PHP.

Utilizar una biblioteca gratuita para crear un PDF desde MySQL con PHP.

Crear y eliminar una sesi n en PHP7.

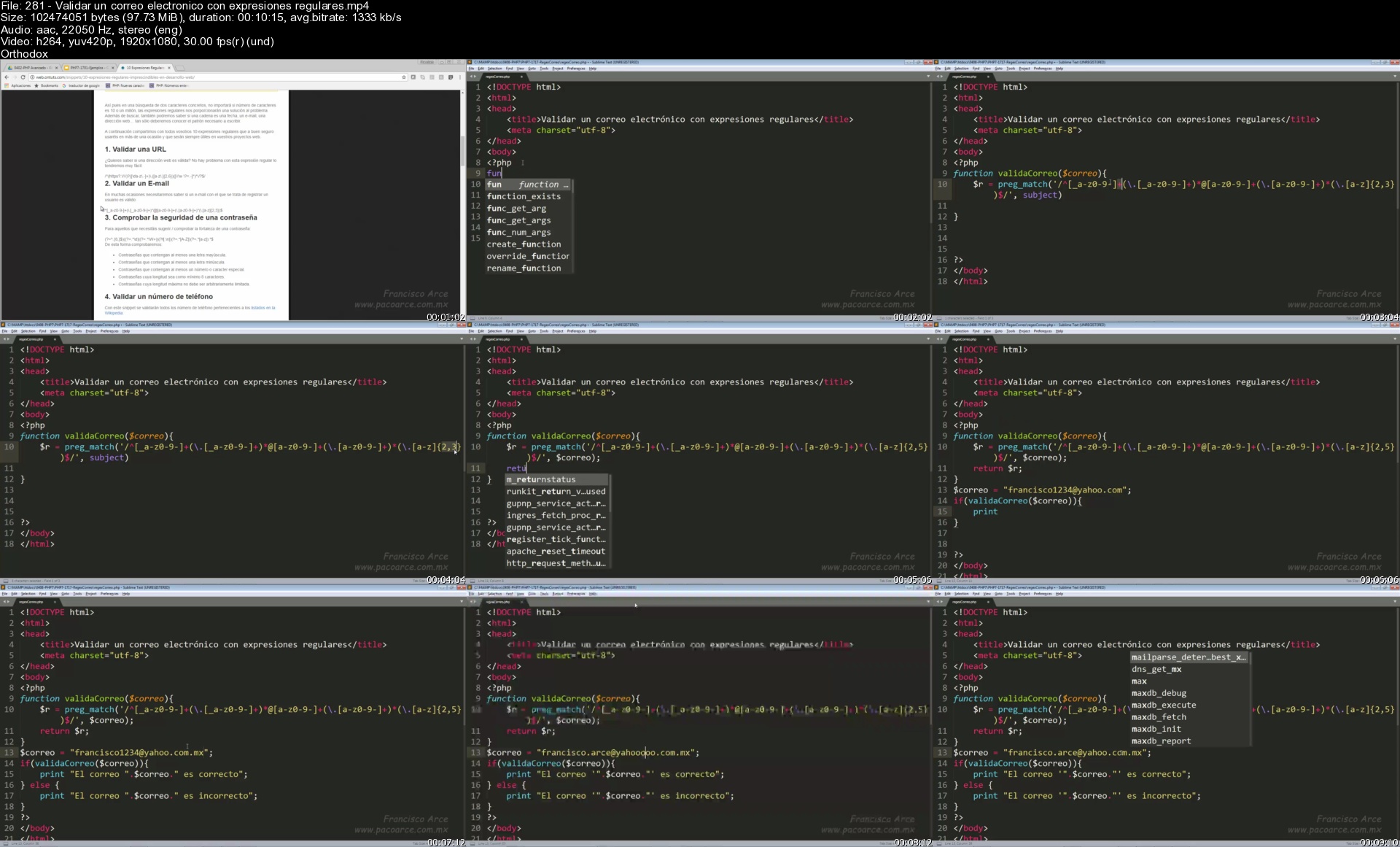

Realizar expresiones regulares en PHP.

Aprender a depurar su c digo con las aserciones y sus nuevas caracter sticas con PHP7.

Aplicar filtros para sanar y evaluar cadenas externas, como los formularios, bases de datos, galletas, etc.

Conectar algoritmos de JavaScript, AJAX, PHP, MySQL y XML.

Requirements

Conocimientos b sicos de HTML y CSS

Computadora para instalar XAMPP, MAMP o WAMP

Un editor de c digo tipo SublimeText, Atom. Aptana, Dreamweaver (cualquier versi n)

Un navegador de internet, de preferencia actualizado

Description

Incluye el eBook del curso

Con

PHP (actualizado a PHP 8.2)

se han hecho poderosos imperios, como Yahoo y Facebook (tambi n Udemy). Comenzaremos desde lo b sico, conociendo la historia del lenguaje y su estado actual. Revisaremos la formaci n de variables, los ciclos, las sentencias condicionales, los arreglos (o vectores), as como la forma de validar formas de

HTML

. Analizaremos las poderosas funciones para manejar fechas y cadenas. Todo de forma f cil y amena.

Dentro de los ejemplos encontraremos los siguientes:

Una sencilla galer a de fotos tomadas directamente de una carpeta

Subir archivos de im genes de la computadora al servidor

Crear archivos de estado

Enviar un mail con

PHP

Hacer p ginas privadas con sesiones

Conocer la IP, browser y s/o del usuario que nos visita

Manejo de expresiones regulares

Aplicar filtros a las im genes como negativo, contraste, blanco y negro, etc.

Reducir el tama o y el peso de una imagen jpg, png o gif en forma autom tica

Subir un archivo

CSV

a

MySQL

y bajar la informaci n de MySQL a CSV.

Conectarse a un sistema RSS.

Crear una encuesta en l nea.

Crear un sistema ABC o

CRUD

.

Paginar una consulta larga.

Leer un archivo de ayuda para la captura con

AJAX

.

Crear un sistema para el control de estampas con

OOP

.

Crear un contador de visitas y guardar informaci n del usuario con cookies.

Guardar im genes en

MySQL

y descargarlas a disco.

Crear un campo de captcha con

PHP

.

Crear archivos PDF con las librer as

fpdf

y

html2pdf

Este curso est dirigido a desarrolladores Web que deseen realizar aplicaciones en la plataforma PHP-MySQL.. Debes tener conocimientos previos de HTML y CSS. Debes contar con un editor de c digo y un navegador moderno.

Who this course is for

Desarrolladores web

Homepage

Code:

https://www.udemy.com/course/todo-php7

Code:

https://nitroflare.com/view/F47A064952B812D/todo-php7.part1.rar

https://nitroflare.com/view/BEBFA2A378E45A2/todo-php7.part2.rar

https://nitroflare.com/view/F2FEF3031269C94/todo-php7.part3.rar

https://nitroflare.com/view/F7CB8A90281F896/todo-php7.part4.rar

https://nitroflare.com/view/834DDA995871029/todo-php7.part5.rar

https://nitroflare.com/view/678E3FC4E89B1A9/todo-php7.part6.rar

https://nitroflare.com/view/285F82A945FBAEB/todo-php7.part7.rar

Code:

https://rapidgator.net/file/0021f1538d97a341101b562bd5c21459/todo-php7.part1.rar.html

https://rapidgator.net/file/cfddc0a1386b94fc384714ea6f0cb7fe/todo-php7.part2.rar.html

https://rapidgator.net/file/3d9d9b60273153a71a5954e108718caf/todo-php7.part3.rar.html

https://rapidgator.net/file/3767d40d516cf1424e05ce347b039941/todo-php7.part4.rar.html

https://rapidgator.net/file/55a975117c7b15d3d951713b7b2401a4/todo-php7.part5.rar.html

https://rapidgator.net/file/58d36b19c7e37212d4be41bd1dbe5700/todo-php7.part6.rar.html

https://rapidgator.net/file/1b970d4686aa6e285cc0966d885f034f/todo-php7.part7.rar.html